Several factors might lead someone to consider bankruptcy at an early age. Many roads might lead to the same destination on your journey to independence, from student loan debt to seeking to get on one’s finances.

You could hear from older relatives and family members that you’re simply too young to even consider bankruptcy if you find yourself having to make this decision in your twenties or even earlier.

However, those family members and friends are probably not qualified to provide you with the type of helpful guidance you require during such a difficult and perplexing time since they are not attorneys.

It is a good idea to study more about the entire process to better understand your options, including bankruptcy, and how they relate to your particular case.

A Big Step That Should Be Discussed Is Bankruptcy

All Americans deal with debt daily. We start to rack up debt in a variety of ways once we reach a certain age.

The debt we accumulate follows us everywhere we go until it is paid off, from credit cards and mobile phone contracts to college loans and auto loans. It could be a $200 or a $ 1500 loan but that shouldn’t scare you.

In a relationship, especially a significant one, it’s critical to make an effort to learn about your partner’s debt and to enquire about theirs.

If you are married, declaring bankruptcy will affect your spouse, therefore it should be a decision that you both agree on based on your respective incomes and financial situations.

If one spouse can care for the other while you consolidate your debt, reduce your debt, or reach a settlement with your creditors, you may be able to avoid filing for bankruptcy.

Arguments Against Filing for Bankruptcy

Damages Your Credit Rating

Depending on how long it takes to get your discharge or if it’s your second or third bankruptcy, declaring bankruptcy will kill your credit rating and credit score for the following six to seven years, or longer.

It becomes very challenging to qualify for new bank loans, credit cards, auto loans, mortgages, and other credit products at fair interest rates after bankruptcy is reported on your credit record.

While avoiding credit to prevent getting into debt once again may seem like a smart idea, most Canadians find it unreasonable to live without any kind of credit over the long run.

For instance, bankruptcy will hurt your prospects of passing this checkpoint if you’re going to acquire a mortgage for a new house or even pass credit checks to rent a property or find a new job.

Even years from now, creditors can view you as a high-risk borrower and frequently inquire about your bankruptcy history on application forms.

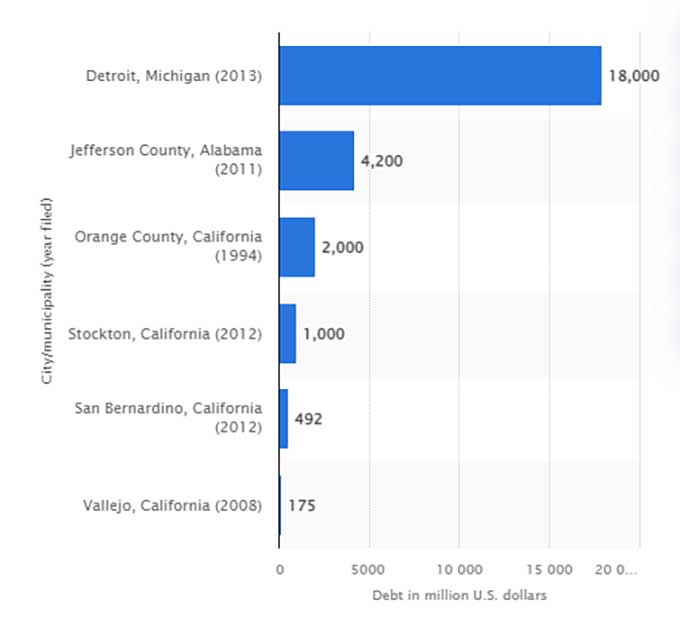

On the other hand, even large municipalities in the United States have filed for bankruptcy. For the period 1953 and 2013, there were 5 of them. But this should not reassure you, but on the contrary, try not to get into debt.

Ranking of the five largest municipalities that filed for bankruptcy in the United States between 1953 and 2013, by approximate debt

It Might Not Completely Eliminate All Debts

Although you might believe that declaring bankruptcy will eliminate all of your obligations, this isn’t always the case.

Most often, it just gets rid of some kinds of debtors, like credit cards or medical debts, while leaving others standing.

For example, it is feasible to pay off unsecured debts that have accumulated on your credit cards, unsecured lines of credit, payday loans, and other personal loans.

However, if you file for bankruptcy, you might not be able to discharge some obligations, including court-ordered penalties, alimony and child support payments, and debts tied to fraud. Another type of debt that is often not forgiven in bankruptcy is student loan debt.

You Could Harm Your Employment Prospects

Your credit report may contain a record of your bankruptcy for seven to 10 years, depending on the kind of bankruptcy you declare.

When you consent to a background check, you give the employer the authority to examine your credit score even though many companies have no interest in doing so.

Your credit will probably be one aspect of your background check, and it might declare you ineligible for a job, if you want to work in any position requiring the management of money, even in non-financial professions within the insurance, finance, legal, or academic industries.

Why is it important? A person’s financial management is a good predictor of how they would handle others’.

It is Pricey

Bankruptcy filing is expensive. Typically, the court filing fee alone costs at least $300. You can also be required to pay legal fees on top of those expenses.

Depending on where you reside, the costs might vary, but a typical instance costs between $800 and $6,000.

On the other hand, declaring bankruptcy to pay off large amounts of debt might be more advantageous than making direct payments.

Better Choice is Available

Take comfort in knowing that there are workable alternatives to bankruptcy that can help you cope with the stress of being in debt if you’re concerned about the long-term effects of filing for bankruptcy.

Consumers frequently learn about additional options for debt relief only after having a free, private visit with a certified credit counselor.

Unknown alternatives to bankruptcy that are available to Americans include debt management plans, debt consolidation, debt negotiation, and consumer proposals. All of these solutions will not severely harm your credit score or financial situation.

You Could Lose Your Home

After declaring bankruptcy, you might not be able to purchase a home for seven to ten years, but there are methods to try to get around this.

More significantly, declaring bankruptcy can result in a future full of rejected rental applications. Before approving you for a lease agreement, many landlords will verify your credit.

An obvious sign that you could be a dangerous renter who won’t pay rent is having filed for bankruptcy.

What Age Must You Be to Declare Bankruptcy?

Legally, you must be at least 18 years old, but it’s doubtful that you will have racked up enough debt in that time to be in significant financial difficulties.

The second time you file for bankruptcy, the process is more difficult and time-consuming, so it’s not something that should be taken lightly.

Bottom Line

Don’t go it alone if you or a loved one is thinking of filing for bankruptcy. The bankruptcy procedure may be challenging for anybody, regardless of age.

It is beneficial to seek legal advice at every stage of the bankruptcy procedure, particularly for individuals who are considering it at a young age.

This content is a joint venture between our publication and our partner. We do not endorse any product or service in the article.