We should have seen it coming; in fact, we did see it coming and still ignored the obvious truth.

We should have seen it coming; in fact, we did see it coming and still ignored the obvious truth.

Volkswagen’s infamous “Diesel Dupe” is a self-inflicted (possibly mortal) wound for the iconic German carmaker. At present, VW is recalling 500,000 cars in the U.S. and has set aside 6.5 billion Euros to cover the expected costs of this scandal.

But this crisis grows more threatening every hour; the amount set aside will not cover a fraction of the ultimate costs. The EPA (Environmental Protection Agency) alone is threatening US$18 billion in fines and the U.S. Justice Department is preparing to launch a criminal probe. Class action lawsuits are springing up everywhere and they could ultimately overwhelm the company.

Why?

Unlike other instances of corporate malfeasance, this was not a technical error (of omission), nor was it an oversight: Volkswagen’s diesel emissions fraud was a highly complex and measured scam. The company deliberately deceived the EPA. It then knowingly doubled down on that lie through its false advertising to the public. It then drove a spike into the heart of its global brand when it intentionally mislead its own customers, many of whom are still in shock.

It is impossible that senior leadership were unaware. Martin Winterkorn, the recently departed CEO of Volkswagen, is a highly qualified engineer with a well-deserved reputation for paying close attention to detail. Moreover, underlings in VW do not make corporate decisions this big, this strategic and this risky – clearly the trail of deceit runs right to the top.

The fallout is starting to spiral out of control, with investigators launching probes in the UK, Italy, France, South Korea and Canada. Germany, which has more to lose than Volkswagen, is also launching a probe, and is keen to get to the bottom of this crisis.

Meanwhile, VW stock lost 35 percent of its value (25 billion Euros) in a single week.

But it gets worse. Consider that disgraced CEO Winterkorn is expected to receive 6o million Euros in severance payments and other compensation, despite presiding over this mess from beginning to end.

How could it happen?

The uncomfortable truth is, Volkswagen senior leaders were simply following the diktats of our governing business ideology, a set of ethical values derived from economists at the Chicago School of Monetarism. In monetarism’s ideological universe, corporate social responsibility is something of an oxymoron.

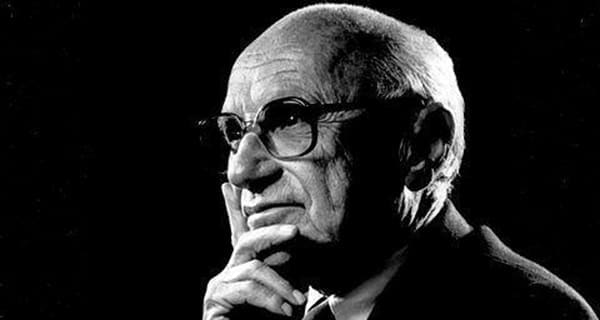

To a certain extent, we can blame the head of the Chicago School, economist Milton Friedman, for starting all this. In a landmark New York Times article back on September 13, 1970, Friedman laid out the monetarist case AGAINST social responsibility for business.

Friedman used this landmark New York Times article to bluntly reinforce the separation of business (good and liberating) and politics (bad and controlling). He gave an establishment voice to the idea that society does not exist when he stated that social responsibility was a “fundamentally subversive doctrine”. “Businessmen, he wrote, who talk this way (about social responsibility) are unwitting puppets of the intellectual forces that have been undermining the basis of a free society these past decades.”

He then went a giant step further, setting the stage for the coming moral crisis in capitalism by maintaining, “ . . . there is one and only one social responsibility of business – to use its resources and engage in activities designed to increase its profits . . ..”

It’s been called the world’s dumbest idea, because it meant that senior management could (and should) ignore society, its rules, its changing standards and concentrate solely on maximizing shareholder returns.

By this standard, Winterkorn was only guilty of getting caught; like the General Motors CEOs who ignored the dangers of its faulty ignition switches, or the Wall Street investment banks and credit rating agencies who ignored the obvious risk of sub-prime mortgages in CDOs (collateralized debt obligations), that launched the 2008 financial crisis.

By the (admittedly) low standards of our time, these CEO’s were simply doing their job, maximizing shareholder value.

We should have seen it coming, and maybe when the dust clears on this Volkswagen mess, we’ll start pointing our rage at the real culprits – economists, the high priests of modern business ethics.

Robert McGarvey is an economic historian and former managing director of Merlin Consulting, a London, U.K.-based consulting firm. Robert’s most recent book is Futuromics: A Guide to Thriving in Capitalism’s Third Wave.

Robert is a Troy Media contributor. Why aren’t you?

The views, opinions and positions expressed by columnists and contributors are the author’s alone. They do not inherently or expressly reflect the views, opinions and/or positions of our publication.