If your home is your castle, and a castle is a fortified residence to keep you safe, then Covid-19 has taught us an important safety lesson: Owning your own home means you become the literal gatekeeper to your own health.

If your home is your castle, and a castle is a fortified residence to keep you safe, then Covid-19 has taught us an important safety lesson: Owning your own home means you become the literal gatekeeper to your own health.

But it isn’t only our physical health that has been impacted by the pandemic. Our financial health has been affected by the pandemic as well. Governmental restrictions on human interaction, social distancing, and similar factors had a profound effect on the housing market in 2019. A report from the U.S. National Library of Medicine and National Institutes of Health explains that, when mobility and discourse are limited between households, developers, banks and investors, among others, it is difficult to transact business. It is hard to sell a house if you can’t even show a house.

However, human ingenuity is changing that. A Time story on selling a home during the coronavirus pandemic reported that “…the chaos is easing. People have figured out how to transfer property with minimal human contact, and the way we buy and sell our homes may never be the same.”

An article in the National Law Review on the impact of the pandemic on real estate transactions reports that laws in many jurisdictions have been enacted allowing realtors to conduct business while obeying social distancing guidelines. Other Covid policy changes have included borrower relief clauses for homeowners and signals to regulated lenders that working with borrowers negatively affected by COVID-19 would not necessarily have adverse regulatory consequences on the lender.

There are also tax breaks for people working from their home offices, vitally important as teleworking has radically increased during the pandemic. The Organization for Economic Cooperation and Development reported that “In Australia, France and the United Kingdom, 47 percent of employees teleworked during lockdowns in 2020. In Japan, which did not institute a nationwide lockdown, the teleworking rate increased from 10 to 28 percent between December 2019 and May 2020.” The OECD further reported “that all countries for which comparable data are available experienced increased rates of teleworking during the Covid-19 pandemic.”

So your home is no longer just a home; it can now also be your home office. That adds extra value to the largest and most valuable investment most people will make in their lifetime – their home – and is leading to an increase in household net wealth.

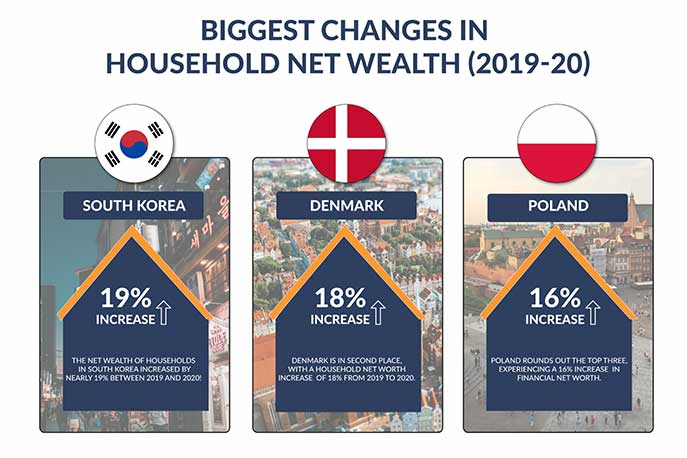

This graphic from Comparethemarket represents just a small sample of increases in household net wealth all over the world

So, not just a home, not just a castle, not just a home office: your home now represents financial security. Hanging on to the single most significant investment you will probably make in your life makes even more sound economic sense. As MarketWatch News reported recently: “It’s been a wild ride for home buyers and aspiring home buyers over the past year, with bidding wars and rising prices – and interest rates held near historic lows.”

MarketWatch also commented on telework: “The big wildcard is the permanency of work-from-home policies or even hybrid models of employment. That will lead to changes in residential locational choices with more households willing to buy a home farther away from job locations and home price growth, therefore, will be stronger in small towns and exurbs compared to downtown locations.”

This may, therefore, be the right time to buy your own home.

That old proverb, “May you live in interesting times,” certainly holds true during the pandemic.

Dana Wilson is a freelance writer.

The opinions expressed by our columnists and contributors are theirs alone and do not inherently or expressly reflect the views of our publication.

© Troy Media

Troy Media is an editorial content provider to media outlets and its own hosted community news outlets across Canada.