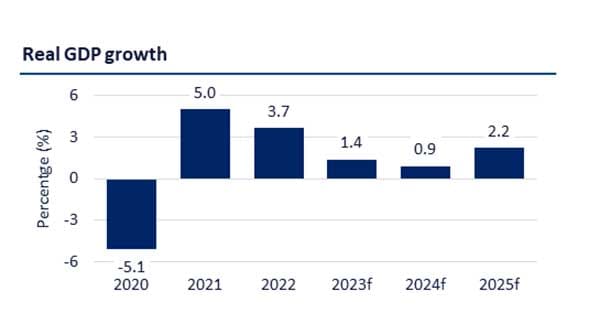

New report identifies multiple challenges affecting GDP outlook in Canada

Canada’s GDP growth rate is projected to dwindle to 0.9 percent in 2024, following a decrease from 3.7 percent in 2022 to just 1.4 percent in 2023.

Among the challenges facing Canada, according to a new report from data and analytics company GlobalData, are a persistent high-cost borrowing environment, a housing crisis marked by critically low vacancy rates, heightened inflation, waning business confidence, declining international demand, ongoing diplomatic tensions with India, and a dip in the popularity of Prime Minister Justin Trudeau.

| Related Stories |

| Widespread financial vulnerability surges in Canada

|

| To boost productivity, we require investments, not subsidies

|

| Canada’s economy desperately needs business investment

|

According to the report, Macroeconomic Outlook Report: Canada:

- The inflation rate, while expected to fall from 6.8 percent in 2022 to 3.7 percent in 2023, remains above the Bank of Canada’s preferred target range of two percent. After falling to 2.8 percent in June 2023, inflation again surged to four percent by August 2023. Food inflation is anticipated to decrease from 9.5 percent in 2022 to 4.7 percent in 2023.

- Canada has experienced robust employment growth, adding 60,000 new jobs in September 2023. The wages of permanent employees have also increased by 5.3 percent annually as of September 2023, prompting concerns of further interest rate hikes by the Bank of Canada.

- Canada’s housing crisis remains a pressing concern, particularly in major cities like Toronto, Vancouver, and Montreal, where vacancy rates have plummeted to one percent or lower.

- The strained relationship with India is expected to impact trade prospects, potentially hindering Canada’s access to the Indian market, disrupting exports, and straining economic partnerships. Merchandise trade between the two nations amounted to $10.5 billion in 2022, compared to $4.1 billion in 2010.

- Mining, manufacturing, and utilities contributed 17.7 percent to Gross Value Added (GVA) in 2022. Wholesale, retail, and hotel activities accounted for 12.6 percent, and construction made up 7.7 percent. In 2023, these sectors are projected to grow by 3.5 percent, 5.2 percent, and 4.1 percent, respectively, considerably slower than the substantial growth rates observed in the previous year.

- There is some hope in the Investing in Canada Infrastructure Program, which allocates over $33 billion in funding until 2025. The program aspires to support public projects across the country, bolstering growth in the construction and related sectors. GlobalData predicts that the construction sector’s GVA will grow at an average annual rate of 4.8 percent from 2023 to 2025.

- Canada is a significant player in the mining industry, producing minerals such as potash, uranium, platinum, aluminum, gold, and copper. In 2022, it became the world’s fourth-largest gold producer, with an 11 percent increase in output.

- Canada boasts substantial oil and natural gas reserves, with its oil sands playing a pivotal role in the global liquid fuel supply. In February 2023, Equinor received a license for a significant oil discovery in Newfoundland’s Flemish Pass Basin, estimated to contain approximately 385 million barrels of recoverable oil. This discovery is expected to enhance Canada’s oil reserves and contribute to increased oil production.

- In terms of risk assessment, Canada is categorized as a low-risk nation, ranking 18th out of 153 nations in the GlobalData Country Risk Index (GCRI Q2 2023). The country scores favourably across various parameters, including macroeconomic stability, demographics, social structure, technology, and infrastructure.

According to the report, Canada is confronting significant economic and political hurdles, with the declining economic growth rate being a key focal point. If Canada is to overcome these challenges, it adds, a premium on maintaining political stability, boosting investor confidence, and adopting customized fiscal policies that foster growth, innovation, and employment opportunities must be maintained.

| Staff

The opinions expressed by our columnists and contributors are theirs alone and do not inherently or expressly reflect the views of our publication.

© Troy Media

Troy Media is an editorial content provider to media outlets and its own hosted community news outlets across Canada.